When we talk about clean energy and sustainable finance, a few key terms often get mixed up: Clean Energy Tax Credits, Carbon Credits, and Renewable Energy Certificates (RECs).

Oct 2, 2024

While these "credits" all provide a financial mechanism to support clean energy projects, it is critical that climate and sustainability professionals understand the distinct effects these instruments have for their own organizations, and the relative role they play in U.S. clean energy investment.

Tax credits have a particularly outsized impact, serving as the financial backbone of clean energy projects and a key driver of the broader goal of decarbonizing the U.S energy system. In 2024, Tax Credit Transfer (TCT), a new tool enabled by the Inflation Reduction Act (IRA), is likely to generate five times the investment in clean projects compared to the voluntary US REC and global carbon market combined. If you’re involved in sustainable investing, tax credits should be a foundational consideration in your strategy due to their unique power to support clean energy at scale while also increasing corporate profitability.

How Clean Energy Tax Credits Differ From Other Voluntary Credits

For the purpose of this comparison we will focus only on the use of voluntary credits, as opposed to carbon credits or RECs that are used in compliance markets where companies are required to obtain credits. While compliance-based credit purchasing is undoubtedly important, the purpose of this discussion is to help differentiate the tools and strategies a sustainability professional or sustainable investor would use at their discretion.

In this context, clean energy tax credits, carbon credits and RECs all serve different purposes.

Carbon credits and RECs are applied against a voluntary account of corporate environmental impact. RECs address a company’s energy consumption, while carbon credits are applied against the greenhouse gas (GHG) footprint. While these credits improve a company’s sustainability profile, their most direct financial effects are increased costs.

On the other hand, under the Inflation Reduction Act (IRA), clean energy tax credits are allowed to be sold in a one-time sale, known as a Tax Credit Transfer (TCT). For buyers, these tax credits are applied against their federal income taxes. Businesses typically buy tax credits at a discount, creating a direct financial benefit that increases after-tax profit.

From a clean energy project developer’s perspective, monetizing tax credits is essential. They provide critical financing for renewable energy projects. For example, a popular form of clean energy tax credit, the Investment Tax Credit (ITC), can cover between 30% to 60% of a project’s costs. This isn't just a perk—it's fundamental to the financial viability of many US renewable projects.

The Market Impact of Clean Energy Tax Credits vs. other Voluntary Credits

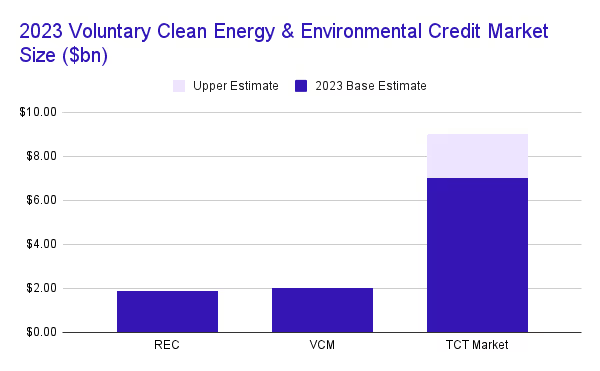

The size of these markets reflects their relative importance to the growth of US clean energy. In 2023, the U.S. voluntary REC market was valued at around $1.9 billion, while the global voluntary carbon market (VCM) was estimated to reach $2 billion. These are substantial figures, but they pale in comparison to what’s happening in the tax credit space.

With the passing of the Inflation Reduction Act (IRA), the tax credit transfer market was estimated to be between $7-$9 billion in its first year of activity, 2023, and is estimated to triple in size in 2024. This highlights just how critical tax credits have become for clean energy investment. The scale is simply unmatched, and it underscores the difference in financial weight between tax credits and voluntary carbon or REC markets.

Clean Energy Tax Credits: a Major Opportunity for Sustainability Professionals?

While it’s clear that tax credits are playing an important role in US clean energy, some sustainability professionals or sustainable investors may question if they can achieve impact by utilizing these instruments.

Corporate participation is the key ingredient for scaling these efforts and many are still sitting on the sideline. The tax credits your organization purchases might have the most direct impact on clean energy deployment compared to any other sustainability-focused instrument available. And, while TCT has already catalyzed significant corporate investment in clean energy, there is enormous potential for growth.

Additionally, sustainability professionals can bring important purchasing criteria to selecting tax credits: directing credit purchase towards projects with greater environmental, social, or economic benefits, or localized efforts to support clean energy projects near existing business operations.

Finally, the after-tax profits generated through these credits often create a new budget for sustainability initiatives. This surplus can be reinvested into more sustainable projects, further amplifying your organization’s impact.

Supercharge Sustainable Finance with Clean Energy Tax Credits

In conclusion, clean energy tax credits are a vital tool to accelerate clean energy projects and can be a central strategy to support corporate sustainability efforts that are substantial and scalable. Unlike RECs and carbon credits, they align with a business's core goal of profitability while providing a substantial benefit to projects that mitigate GHG emissions. Understanding their role and leveraging them effectively could be one of the most impactful sustainability decisions your organization makes.

Simplify tax credit transfers with Basis